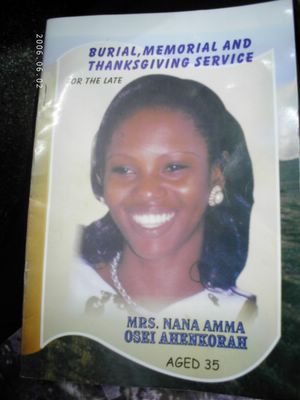

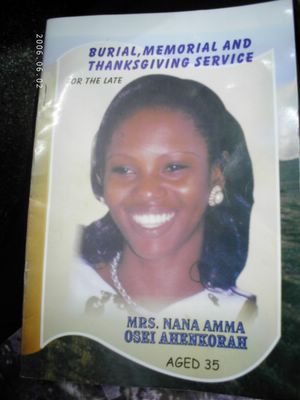

Home deliveryI woke up on Saturday 27 May a very preoccupied man. I would be attending the funeral of a truly good, beautiful, caring and loving married friend, Mrs Nana Amma Osei-Ahenkorah.

I still cannot believe that I have not cried. Maybe the experience of t he demise of Samuel, my one and only elder brother, on 8 May, 1991, has fortified my attitude on the significance of death. Don’t get me wrong: death is still a very painful "enterprise", as it were, for the family and friends of those left behind, but taking succour from the fact that we shall meet again, maybe mitigates the pain.

I still see no reason why one should hold back from crying. On Saturday, I was so distraught—to the extent that after attending the cemetery service (wanted to know where she is buried), I seemed okay, but upon going back home, couldn’t help talking about her to my parents. My Dad -- jokingly I hope – was wondering whether Nana Amma was not my girlfriend. As I confessed elsewhere, I initially had a crush on her, but knowing there was no way anything could happen between us, we proceeded as friends. She became like a big sister to me—we confided in each other on a lot of things. I will admit, upon retrospect, that not only do I have her picture on my desk at work, but I do think I loved her a great deal.

It regrettably had to take her demise for me to realize this. I am just waiting for the tears to come. Maybe like that of my brother’s, it is delayed, and will only ‘surface’ in a couple of week’s time… What is clear, though, is that Nana Amma has veritably gone "home", where she belonged.

We shall meet again:-)

On another case of home delivery, it was with great joy that I stumbled over a copy of the "

Daily Graphic" on Wednesday night around ten thirty, lying quietly on my terrace. It had been delivered by the Home delivery service who had thrown it there, clearly afraid of the incessant barking by our dog, Fenix. I got a copy of the 1 June edition, which looked like the picture to below left:

ATM Frenzy

ATM FrenzyYesterday was a deeply hectic day. I needed money from the bank, and the most convenient place to get it was by way of an ATM, especially one of those visa-branded ones like this one below:

So, I went to an ECOBANK one at my place at A&C Shopping Mall (pictured right). That was out of order. Quickly, I called a taxi, and went to the University campus area one (Legon). Also out of order. So, on I went to Silver Towers, where Stanbic Bank and ECOBANK, along with Ghana International Airlines share lodging. Also out of service. On back to the so-called EZI-Services (hosted by ECOBANK) at the Airport Shell. No luck.

37 Liberation Road (SG-SSB bank) proved equally futile—as did the ATM at On the Run, not too far from 37 military hospital.

So, it was decided to go to Ring Road Central (RRC). Thankfully, I stopped at the ECOBANK branch there instead of going to SG-SSB that was up ahead.

Hurrah!! Result. Card in, money out.

The prospect of facing a queue was not on my list of things to do.

I then went back to the office, wondering whether it might not just be a good idea to have a single ECOBANK Savings account at the plush branch located at Silver Towers. Time will tell…

Speaking of ECOBANK, the share offer is in its final day today. Since 15 May, the bank has been offering 8,750,000 shares or so for sale, with one share selling at ç11,000, or almost €1.00.

Suffice to say that my parents and I are now proud shareholders in our small way of ECOBANK.

The future might just be that much brighter.

Health WatchAccording to this morning's

Statesman newspaper, which carried the headline "HOSPITALS HOLD GOVT TO RANSOM", the Ghana Medical Association (GMA) is facing the prospect of many strikes in the country’s hospitals. Government has consistently failed to present new payment structures and, as such, it is causing a number of strikes, with doctors saying that they won’t go to work unless arrears of months have been paid.

The most distressing thing about this situation is that whilst they are entitled to strike, what, then, happens to the rest of us who want medical assistance. Most people cannot afford to go private, so what do they do? Go untreated? The paper maintains that since Monday, Ghana’s biggest teaching hospital, Korle-Bu, has had junior doctors go on strike! They claim that until money from January to May 2006 is paid, they will not resume work.

Apparently, if this news is anything to go by, the NDC, former government in power, did something right with the so-called

Additional Duty Hours’ Allowance (ADHA), introduced in 1999, and sadly terminated by the incumbent government last year. Doctors who were then earning GHC 6,000,000/month (almost $US700) under that scheme are now earning just under half that.

Without a doubt, a lot more needs to be done by the NPP government on healthcare policies -- especially those of healthcare workers -- otherwise people might go down the private route – unprepared, and with dire consequences on the families of those that remain if things don’t go well in private either…

SOME THINGS I REALISED I LIKE ABOUT ACCRA:

1. the verdant scenes (greenery) almost replete in the capital (on the left--

a view of the road that leads to the airport (right) and up ahead, Airport Shell station);

2. although could have been better-designed, the Tetteh-Quarshie interchange (

a view of it going towards Madina, Aburi, East Legon);

3. the ATMS!!

SITE OF THE DAY

CITI97.3FM’s site has been re-vamped. Go check it out:

http://www.citifmonline.com

We've all been there before: walking in town--perhaps a more up-market place like the Accra Mall or some place near Osu Re: and catching sight of a new publication.

We've all been there before: walking in town--perhaps a more up-market place like the Accra Mall or some place near Osu Re: and catching sight of a new publication.